An inside look at MedcoEnergi’s cost-efficient business model

HR Insider is a regular in-depth feature exploring the people management teams of some of the region’s most prolific organisations.

Between 2014 and 2016, the global price of oil plummeted to record lows. From US$113 to under US$27 per barrel in less than two years; the sharp drop impacted almost every economy and every business in the world. Even today, the price has stabilised around US$55 and there are no expectations for it to recover to its previous heights in the near term.

For the most part, that impact has been a positive one. Cheaper oil has meant lower business costs for almost every industry, and at least part of the world’s economic growth since 2015 can be attributed to it.

But spare a thought for those in the global hydrocarbons business itself. This is an industry marked by large-scale, multinational projects involving dozens of partners, and some seriously long-tail investments. When the expected revenue from those projects falls by 76% in just over 18 months, it brings a new meaning to the concept of a “volatile” business environment.

So perhaps spare a thought also for anyone charged with keeping those fractured, often fearful workforces engaged and motivated for the challenges ahead.

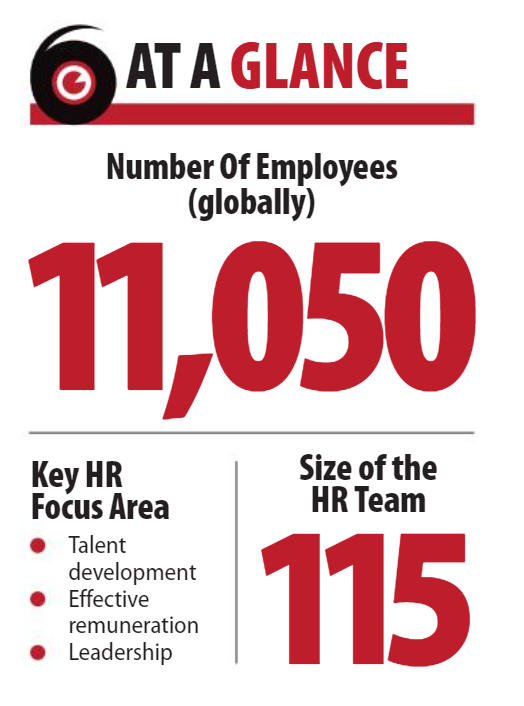

One such HR leader still working at the coalface is Amri Siahaan (pictured below). As the Chief Human Capital and Business Support Officer of Indonesian resources heavyweight MedcoEnergi Internasional, he has been responsible for not just navigating the impact of the low oil-price environment on a workforce of over 11,000, but also taking advantage of it.

“MedcoEnergi sees the current low oil price environment as an opportunity to grow our company,” he tells HRM Magazine. “Instead of downsizing our workforce, Medco is keeping the workforce to support the growth and prepare ourselves for the upturn of the industry.”

Now, with the oil price only somewhat recovered, the company is forging ahead, and Siahaan says a highly skilled and stable workforce is one of the key drivers.

Cutting cost, not staff

That did not happen by accident. Siahaan says times were difficult but a lot of energy and resources were invested in preparing the organisation for the brighter days ahead. The company now aims to do the same things and more with greater cost-efficiency and productivity.

“One of our key strategies to survive in the current condition has been to continue our cost efficiency efforts and become part of the cost leadership in the industry,” Siahaan says. “We are consistently able to maintain our production costs lower than our peers.”

Indeed, in the tumultuous year of 2016, MedcoEnergi reduced its hydrocarbon cash (production) costs by close to 30%, from US$12.30 per barrel of oil or its equivalent in natural gas in 2015, to US$8.80 by the end of 2016.

HR led by example on this front, and Siahaan instituted a number of programmes to get more out of both the HR department itself, and also each individual headcount across the organisation without necessarily spending more direct cash.

“(The) Human Capital (team) continuously tries to find ways to design and implement HR programmes and interventions that can give the most added value to the organisation in the most cost-effective manner,” he says.

In particular, a new compensation and benefits regime was rolled out last year.

The oil and gas sector offers a relatively high amount of its work on a project basis, with big rewards for successful exploration and production assignments lasting from a few weeks to up to two years or more. But MedcoEnergi sought to improve the balance between short-term and long-term incentives across the organisation.

Siahaan says the programme aimed to push back scheduled cash incentives into later years, while maintaining engagement and loyalty across the permanent workforce.

“Our effort was to maintain our competitiveness in the (talent) market in the most economical way,” he said.

Training and systems overhaul

Siahaan also adjusted the balance between “buying” talents on the open labour markets, and “building” them from within.

With the falling oil price, the Jakarta-based HR team found much greater value in transforming the organisation’s learning and development system, than in competing across borders for established skill sets.

“We moved to leverage in-house training resources, and also e-learning, to deliver most of the common and basic training needs,” he said. “These were supplemented by ‘fit-for-purpose’ external training and development programmes that addressed specific and critical gaps.”

The HR team has also been undertaking an internal process improvement project, in which data, dashboards, and HR systems are being better integrated for greater practical insights and service delivery.

Check out part two of this story, which looks at the oil and gas company’s talent development approach.